Lift approvals & reduce defaults

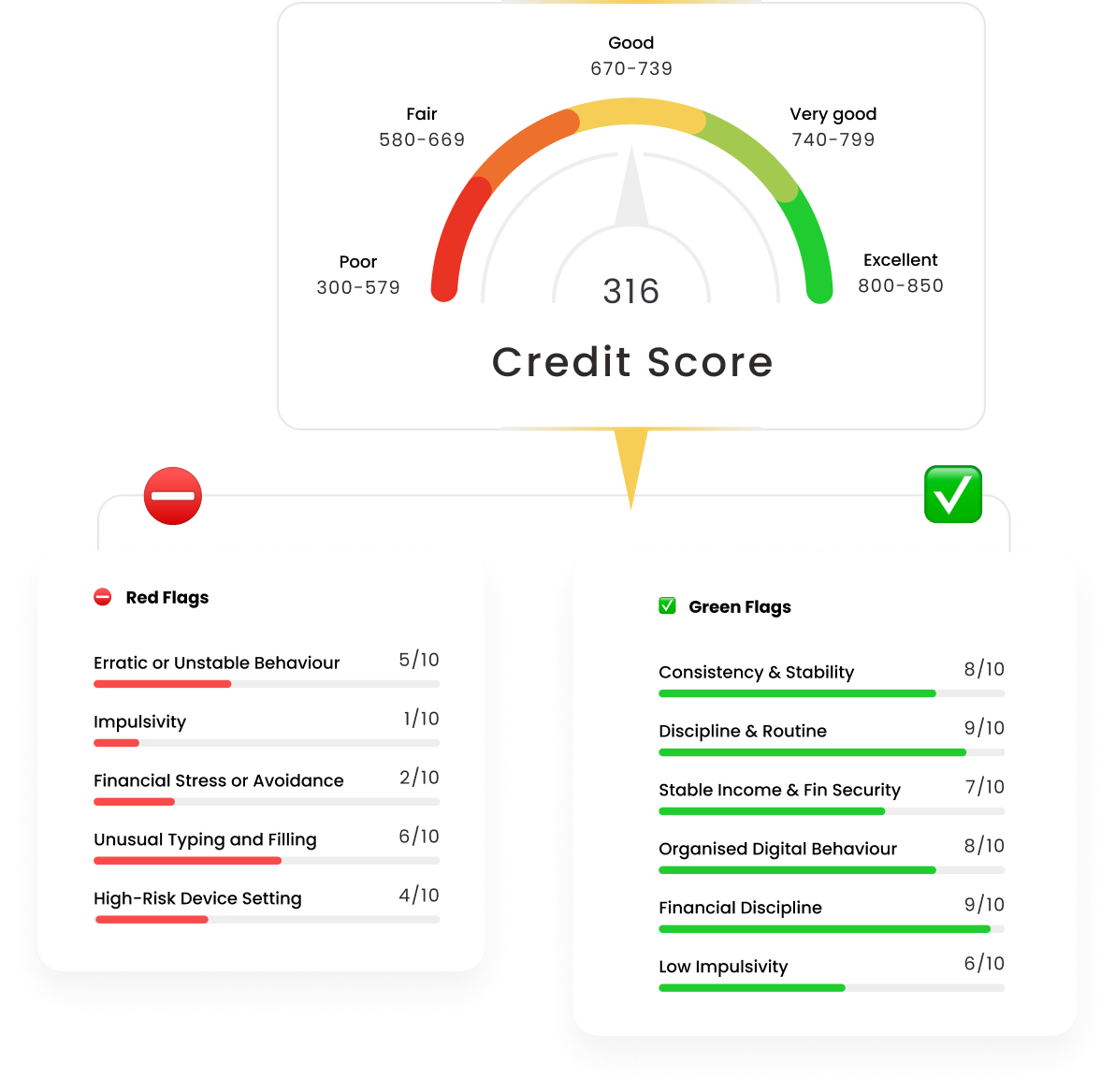

Behavioural and device metadata to enhance your credit risk assessment for every applicant, even thin-files and unbanked.

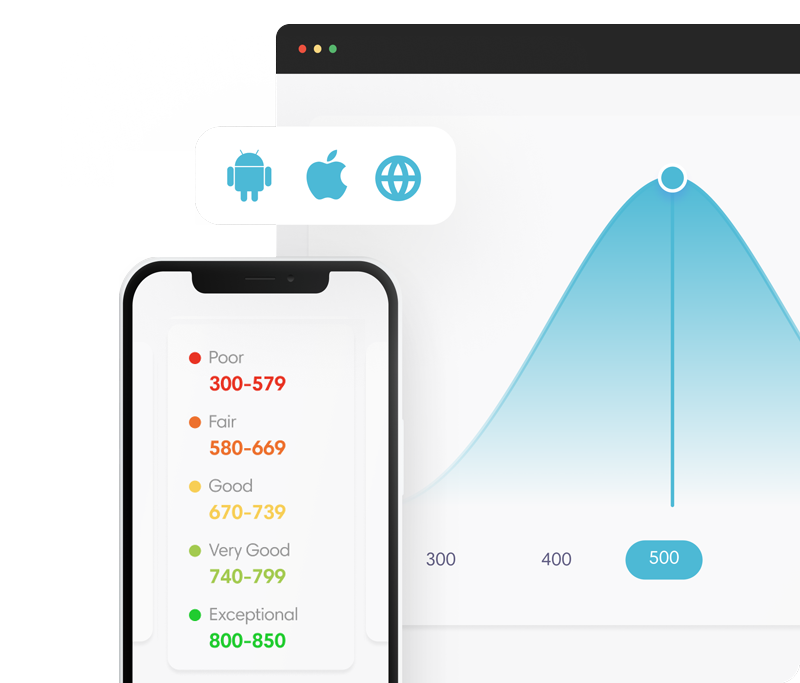

Privacy-first, No PII, Frictionless, Mobile & Web SDK.

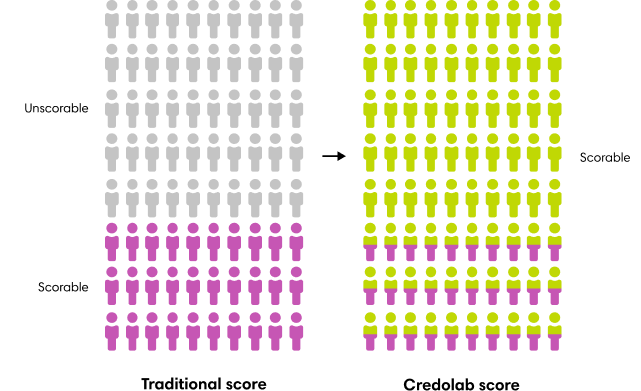

Traditional scoring leaves too many

good customers behind

Stop rejecting profitable borrowers while letting risky customers through.

Complement your existing scoring tools with predictive scores based on device and behavioural metadata.

Lower cost of risk by 21.9%

Increase approvals by 32%

Real-time scoring in <1 second

The scorecard will lead to a significant 30% improvement in our approval rate while maintaining our risk levels at an optimal balance.

This outcome speaks volumes about the effectiveness and precision of Credolab.

Mónica Jiménez Carmona

CrediOrbe

Head of Product

Mónica Jiménez Carmona

CrediOrbe

Head of Product

Easily increase your predictive power with alternative data

Plug features based on device and behavioural data into your existing models. No UI changes needed.

Evaluate credit risk for every applicant in less than 1 second. Save on KYC costs.

Collect only user consented, depersonalised metadata. GDPR, CCPA compliant, ISO 27001 certified.

Advanced features: Installed app categories, Battery usage, Device attributes, Typing speed, Scrolling patterns and more.

The integration takes one day, and it's available via mobile SDK for iOS/Android apps and web SDK.

Benefit from free consultation from our expert team, your dedicated success manager, 24/7 support and advanced documentation.

.png)

The SDK was easy to implement and the customer support team was outstanding, making the integration process quick and efficient.

Anand Krishnaswamy

TransUnion

Vice President Product, International

Anand Krishnaswamy

TransUnion

Vice President Product, International

Digital Lenders

A rapidly growing online and mobile lending platform focused on customer journey, superb risk technologies and data science.

Integration Type: Mobile SDK

Solutions Used:

Irina Skipare

Regional Chief Risk Officer

"Credolab has been a strong partner in our mission to provide accessible and responsible lending solutions to the ever evolving needs of millennials and Gen z customers in emerging countries. Since 2021, our collaboration with Credolab has been nothing short of exceptional....”

Credit Bureaus

Círculo de Crédito is a credit bureau that provides current and historical information on the payment behavior of individuals and corporations to financial institutions with the prior authorization of the person to be evaluated.

Integration Type: Mobile SDK

Solutions Used:

Mario Martinez Fisher

Chief Growth Officer, Círculo de Crédito

As the Chief of Growth of one of the most innovative credit bureaus in Latin America, I'm constantly searching and developing innovative solutions, enriched by technology. Our main objective is to promote inclusion and financial wellness for people and companies in Mexico. Credolab's technology allows us to leverage alternative data to score unbanked and underserved individuals, which will help us to foster financial inclusion and increase the size of our scorable population. Their technology is cutting-edge and their team is exceptionally knowledgeable and experienced. I am confident that our partnership with Credolab will be a success, and I am excited to see what the future holds for our two companies

Credit Bureaus

TransUnion is a global information and insights company that makes trust possible in the modern economy. With a leading presence in more than 30 countries across five continents, TransUnion provides solutions that help create economic opportunity, great experiences and personal empowerment for hundreds of millions of people.

Integration Type: Mobile SDK

Solutions Used:

Anand Krishnaswamy

Vice President Product, International, TransUnion

We partnered with credolab to integrate their SDK into our Digital Onboarding solution. The SDK was easy to implement and the customer support team was outstanding, making the integration process quick and efficient. One of the key reasons why we chose credolab as our partner was the quality of their alternative risk score. After testing it with a bank in the Philippines, we realised it was a good complement to our credit bureau score and CreditVision Link product to help TU's clients score every individual, not just the ones already known to the bureau. Embedding credolab SDK in TransUnion Digital Onboarding enabled us to offer businesses with alternative risk scoring alongside identity and fraud management, affordability assessment, decisioning, and digital fulfilment.

Improve your underwriting process:

- Expand Your Addressable Segments:

Score thin-file & NTC customers using 11+ million micro-behavioural patterns from device and web metadata - Reduce Risk Without Friction:

Identify high-risk borrowers and fraudulent applications in real-time, without adding steps to your user experience - Accelerate Decisions:

Make credit decisions in under 1 second with privacy-compliant device and behavioural scores that complement traditional data

Their team didn't just promise solutions; they delivered them.

By integrating Credolab's alternative data into our operations, we've been able to reach segments of the population that were previously out of our reach

Juan Carlos Esquer Ramos

ZazPay

CEO

Juan Carlos Esquer Ramos

ZazPay

CEO